What you need to know about Afterpay, other pay later services

Afterpay, Klarna and Affirm are become increasingly popular with the average online shopper-- but is it too good to be true?

Afterpay, Klarna and Affirm are become increasingly popular with the average online shopper-- but is it too good to be true?

When mom would pull that crumpled receipt from her purse that stretched from her chest to her knees, I knew it was time for new clothes and shoes. Checking out mom’s layaway pickup always came with a certain excitement. I couldn’t wait to have my own items waiting in the back of the store when I was old enough.

Of course, times change.

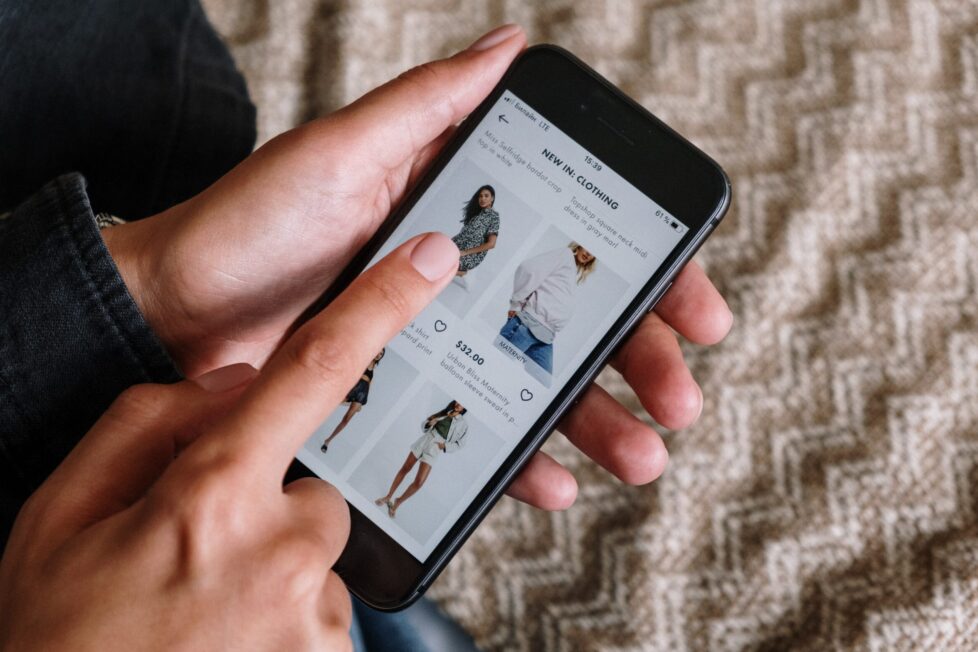

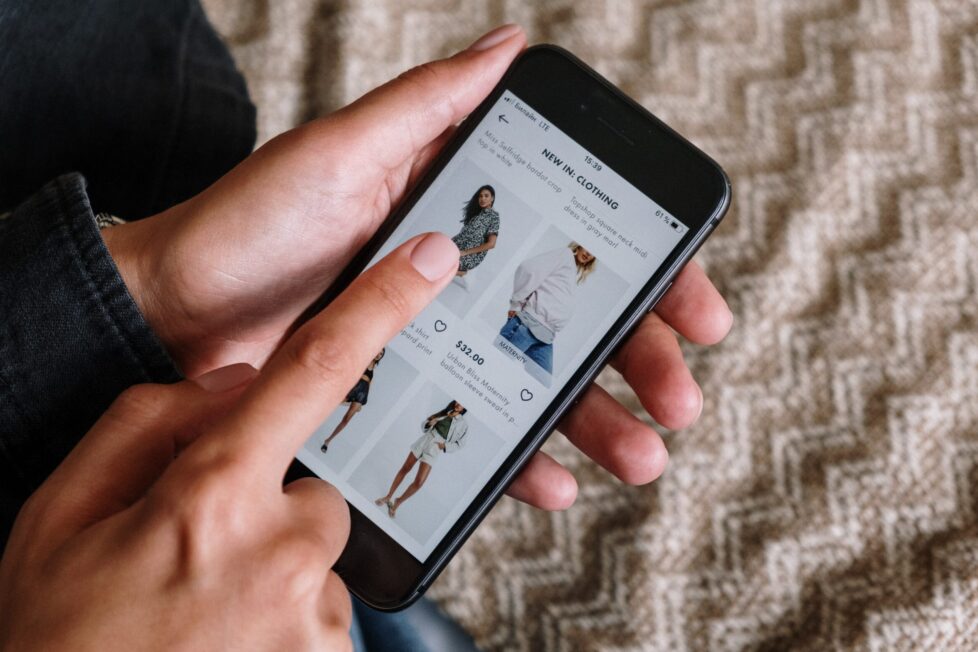

By the time I had money to buy my own clothes, most stores had done away with layaway services— and now, they’re starting to get rid of the storefronts, too. It started happening years ago, but the pandemic has given online shopping the final thrust it needed to become the new normal. This new normal has also built up interest in pay later services, which allows customers to make payments in several installments, typically without interest.

While there are retailers who offer pay later services for their specific products and ones for specific industries, here are the six most popular for the everyday shopper:

At first, I was reluctant to use these services. Sounds suspicious: I can have my items now and pay for them later? I’m a firm believer that if it’s too good to be true, then it probably is. I had questions that needed to be answered first.

MORE MONEY TIPS: 5 tips for a safer digital experience this holiday shopping season

When you ask most people to explain pay later services, they will often compare it to layaway. The installments allow you to purchase more than your immediate budget the same as layaway, but the similarities end there.

Layaway is putting a deposit on your shopping cart. You’re committing to making the full purchase in exchange for the store holding on to your items in the meantime.

With pay later services, a third party is covering the up front cost of your purchase, and then you commit to paying them back. You get your items now.

It’s a form of financing, similar to when you purchase a car or furniture, although definitely taking the place of layaway in the modern world.

When managed responsibly they don’t hurt, but they certainly don’t help. Afterpay, Klarna and other pay later services run soft credit checks, which allow them to quickly assess how much credit to offer shoppers, but they don’t notify the credit bureaus when you pay on time.

The biggest appeal of pay later services is the interest-free tag line, so how do these companies make their money? First, some of these companies do charge interest depending on the size of the purchase and the credit history of the borrower.

Most of the money comes from vendor fees. It’s a service that most retailers buy into because it allows shoppers to purchase more, offsetting the extra cost of the transaction.

During this season of heavy shopping, you decide what’s right for you.

YOU MAY ALSO LIKE

Follow us on social media! Find trending Bayou Beat headlines on Facebook, Instagram and Twitter.